Bigger Fees: SDIRAs frequently come with higher administrative costs in comparison with other IRAs, as specific facets of the administrative process can not be automated.

Believe your Pal could be starting off the next Facebook or Uber? With an SDIRA, you could put money into results in that you think in; and likely take pleasure in bigger returns.

No, you cannot put money into your own private enterprise that has a self-directed IRA. The IRS prohibits any transactions in between your IRA along with your individual business since you, since the proprietor, are viewed as a disqualified human being.

The tax rewards are what make SDIRAs desirable For a lot of. An SDIRA could be both equally traditional or Roth - the account style you decide on will depend mostly on your investment and tax system. Examine along with your financial advisor or tax advisor when you’re unsure that's best to suit your needs.

Just before opening an SDIRA, it’s crucial to weigh the opportunity benefits and drawbacks based upon your specific monetary goals and hazard tolerance.

SDIRAs are sometimes used by palms-on buyers that are willing to take on the risks and obligations of choosing and vetting their investments. Self directed IRA accounts may also be perfect for buyers that have specialised understanding in a distinct segment sector that they wish to spend money on.

Buyer Assist: Try to find a provider which offers committed help, such as access to professional specialists who can solution questions on compliance and IRS policies.

Place only, in the event you’re hunting for a tax effective way to create a portfolio that’s extra tailored in your passions and abilities, an SDIRA could be you could check here the answer.

Opening an SDIRA can present you with use of investments Commonly unavailable via a financial institution or brokerage agency. Listed here’s how to begin:

Adding cash straight to your account. Keep in mind that contributions are subject to once-a-year IRA contribution boundaries set by the IRS.

This involves comprehending IRS polices, controlling investments, and steering clear of prohibited transactions that may disqualify your IRA. An absence of knowledge could end in expensive blunders.

And since some SDIRAs which include self-directed conventional IRAs are subject matter to needed bare minimum distributions her comment is here (RMDs), you’ll should system in advance to make certain that you may have enough liquidity to meet The foundations established via the IRS.

Real estate property is one of the most popular solutions between SDIRA holders. That’s due to the fact you'll be able to invest in any sort of real estate which has a self-directed look at this website IRA.

Consequently, they have a tendency not to market self-directed IRAs, which supply the flexibility to take a position in a very broader range of assets.

No matter if you’re a financial advisor, investment issuer, or other economic Qualified, take a look at how SDIRAs can become a powerful asset to develop your online business and reach your professional objectives.

Nevertheless there are lots of Advantages connected with an SDIRA, it’s not without having its very own disadvantages. A number of the frequent reasons why buyers don’t opt for SDIRAs incorporate:

Complexity and Duty: With the SDIRA, you have extra Management above your investments, but Additionally you bear extra accountability.

Of course, property is among our clients’ most favored investments, sometimes named a real estate IRA. Consumers have the choice to invest in almost everything from rental Attributes, commercial real-estate, undeveloped land, mortgage notes and much more.

Being an Trader, nonetheless, your choices are usually not limited to stocks and bonds if you select to self-direct your retirement accounts. That’s why an SDIRA can renovate your portfolio.

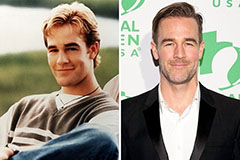

James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Kane Then & Now!

Kane Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!